Yes, the real estate market in Houston has slowed down, but it certainly is not out. Low interest rates (for now) and rising oil prices (still down but making a come back) could create a great opportunity for Houston’s home buyers in the 3rd and 4th quarter of 2016. Here’s on a quick timeline of where the market has been and our best guess on where it is going:

WHERE HAVE WE BEEN?

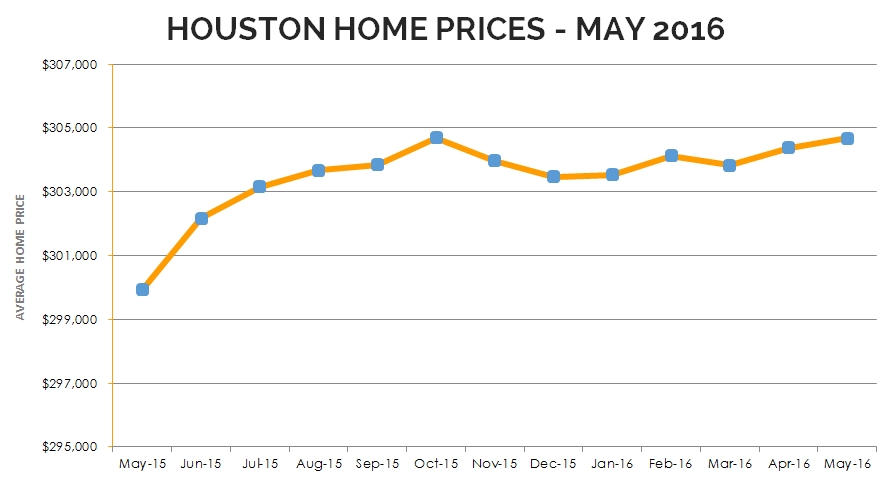

Over the past 6 months, the Houston real estate market has been in a state of flux. After 3 consecutive years of double digit annual price appreciation in many Houston neighborhoods, home prices have flattened. This slowdown has been spurred primarily over anxiety related from declining oil prices. Being the Energy Capital of the World, fluctuations in energy prices are of particular interest and have indeed led to some layoffs at the big Energy giants. As a result, home price appreciation growth has slowed to a crawl. At the end of April, average homes prices in the City of Houston had only grown by 1.61% year over year.

WHERE ARE WE NOW?

After dropping down to as low as $30 a barrel, oil prices have risen near $50 a barrel. However, we have not seen much of a change in the level of real estate activity. Inventory levels are really low, especially in the Inner Loop neighborhoods that Norhill primarily serves. In the city of Houston, there is only 4 months of available inventory. These low inventory levels is actually good news for home sellers. Home prices remain stable, even though there aren’t that many buyers currently in the market.

WHY SHOULD YOU BUY IN 2016?

Assuming you are like most people and you will own your next home for 5+ years, 2016 might be a good time for you to buy. Over the past several months, we have seen a lot of prospective home buyers put off buying until they had more clarity around the Houston economy, and to a smaller extent, the presidential election. If the Energy industry stabilizes, we will start to see many of these prospective home buyers enter the market after the election. This pent up demand could create another spike in home prices similar to the activity we saw after the 2008 downturn.

Furthermore, a Fed rate hike in mid-June and beyond could help to push mortgage rates higher. Although it looks more likely than it has in the past, we will admit that experts have predicted higher interest rates many times over the past several years.

Although we certainly would not recommend going out and buying the first home that comes along, it might be prudent to get the home buying process started.

Average 30 Year Fixed Mortgage Rates from Mortgage News Daily

Feel free to continue browsing our site and learn more about our approach to real estate. If you are ready to get your home search started, click here to schedule an appointment with one of our agents.