Despite the holiday season, low inventory, and a global pandemic, the Houston real estate market continued its record pace in November. Mortgage rates remain at or near all-time lows and homebuyers continue to take advantage.

According to the Houston Association of Realtors, single-family home sales across greater Houston totaled 7,990 in November compared to 6,359 a year ago, a 25.6 percent jump. The luxury home market continues to lead the way. Sales for homes priced at over $750,000 surged 88.4 percent compared to November 2019. Homes priced between $500,000 to $750,000 jumped 72.2 percent year-over-year.

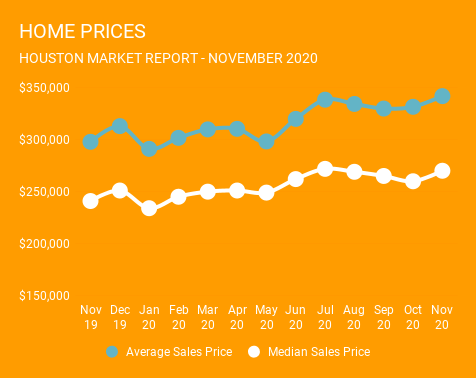

The single-family home median price rose 12 percent to $270,000 while the average price increased 15 percent to $341,765.

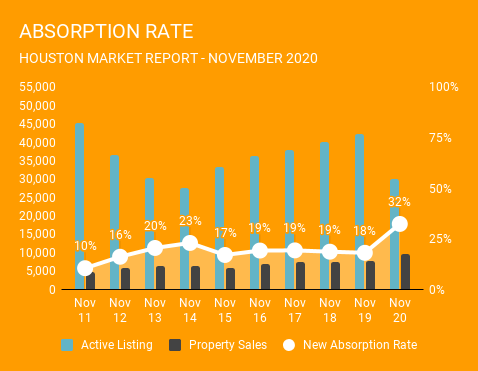

According to HAR, total active listings, or the total number of available properties, dropped 27 percent from November of last year. Total Sales on the other hand increased by 28.1% to 9,660 from November 2019. As a result, the absorption rate for November 2020 was 32% compared to 18% in November of 2019.

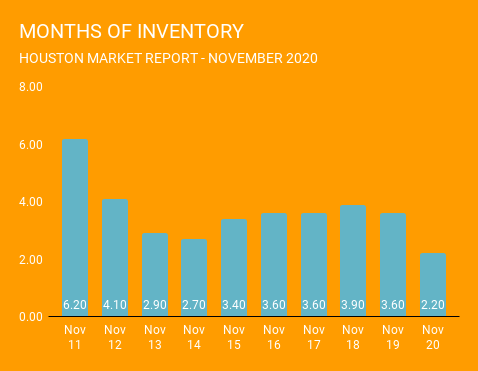

Higher absorption levels have also impacted the speed of home sales. Days on Market (DOM), or the number of days it took the average home to sell, lowered from 64 to 46 days just a year ago. Due to a slowdown in new listings, single-family home inventory continues to fall, with 2.2 months supply in November versus 2.4-months in the previous month. For perspective, housing inventory across the U.S. stands at a 2.5 months supply, according to the most recent report from the National Association of Realtors (NAR).

**Months inventory estimates the number of months it will take to deplete current active inventory based on the prior 12 months sales activity. This figure is representative of the single-family homes market.

As we close out the year, inventory levels will continue to tighten and tighten. After January 1st, we should see an uptick in new inventory, so interested home buyers should be prepared to jump on those properties. Buyer interest remains high and is expected to continue into 2021.