April 2024 saw a positive shift in the Houston real estate market as it rebounded from a sluggish start to the spring homebuying season. The market not only recovered but also expanded its inventory to levels not seen since before the pandemic, enhancing opportunities for both buyers and sellers.

Key Highlights from the Houston Association of Realtors (HAR) April 2024 Market Update:

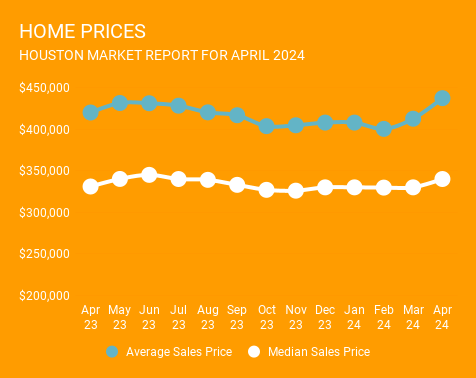

Home Pricing: The average price of a single-family home increased by 4.6% to $437,198, and the median price increased by 3.0% to $340,000. For existing homes (i.e. excluding new construction), the average price rose 6.8 percent to $442,773 and the median sales price rose 6.1 percent to $339,500.

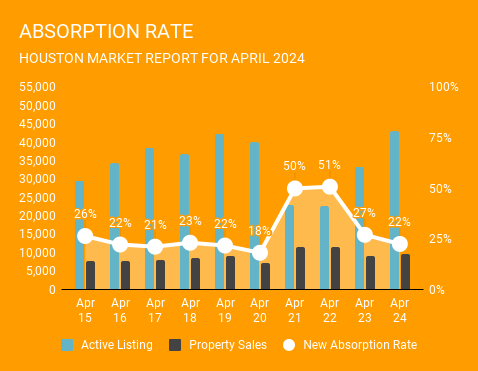

Likely to Sell: According to HAR, total active listings, or the total number of available properties, increased 32.3 percent to 43,044. April sales of all property types totaled 9,611 up 8.7 percent compared to April 2023. As a result, the absorption rate, which is a measure of any given home’s likelihood to sell, for April 2024 was 22 percent. This is back in line with the very normal absorption level pre-pandemic. At these levels, prices tend to move up moderately, but buyers still have choices and time to shop around.

Luxury Market: All housing segments enjoyed an upturn in sales, particularly the luxury market ($1 million+), which surged by 33.8%, despite comprising only 4.8% of the market.

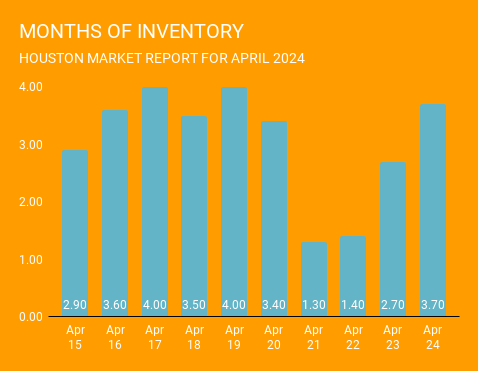

Inventory: The supply of homes rose to a 3.7-months supply, the highest since October 2019. Like the Absorption rate, these numbers have settled back into more normal pre-pandemic levels. According to the latest report from the National Association of Realtors (NAR), national housing inventory is currently at a 3.2-month supply. Generally, a supply of 4.0 to 6.0 months is considered a “balanced market,” where conditions do not particularly favor buyers or sellers.

Single-Family Homes Update:

April’s home sales for single family homes reflected only the fourth increase in sales over the past 12 months, with significant sales growth across various segments. Days on market decreased from 56 to 49 days, indicating quicker sales, and inventory levels rose significantly from last year.

Townhouse/Condominium Trends:

The inventory of townhomes and condominiums reached a four-year high, with supply growing from a 2.3-months supply to 4.5 months. However, sales in this sector saw a slight decline of 1.3% year-over-year, with minor adjustments in average and median prices.

April Monthly Market Insights:

The market’s rebound in April was marked by a notable 9.2% year-over-year increase in single-family home sales. Total property sales also rose by 8.7%, and the total dollar volume grew from $3.5 billion to $4 billion. Single-family pending sales increased by 10.3%, and active listings were up by 32.3% over last April.

Looking Ahead:

With the Houston market experiencing growth in both sales and inventory, the outlook for the remainder of the spring season looks promising. This resurgence is especially significant given the challenges of elevated interest rates, showcasing the market’s resilience and potential.

As we move further into the spring selling season, the Houston market presents varied opportunities for both buyers and sellers. Engaging with a knowledgeable local realtor, such as those at Norhill Realty, can provide critical guidance and insights, whether you are buying or selling in this intricate market. For a comprehensive overview and expert advice, consider connecting with Norhill Realty to navigate these trends effectively.

Fill out the form to get started.

GET MATCHED WITH AN AGENT