Over the past couple of weeks, we have seen a bit of a rebound as the State of Texas starts to open up post lockdown. Much of this rebound has been led primarily by pent up demand from folks relocating to Houston as well as first time home buyers who are ready to take advantage of lower mortgage rates.

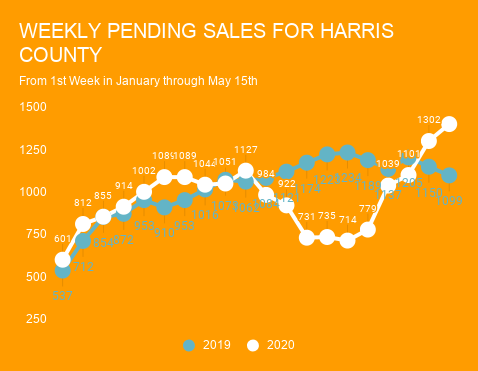

In a volatile market, pending sales is one of the best short term indicators we can reliably track to discover the trajectory of the market. Based on our research, pending sales in Harris County have come roaring back over the past 4 weeks. During the past 2 weeks, we have even surpassed pending sales numbers for the same period last year. However, if we look at the numbers over the past 8 weeks in total, pending sales are down 17% when compared to the same period in 2019.

Now that we are a couple of months into our new Coronavirus reality, the impact of the virus is starting to show up in our more lagging metrics, like home prices, total sales, etc.

According to the Houston Association of Realtors, single-family home sales across greater Houston totaled 6,199 in April. This is down 19.1% from the same period in 2019.

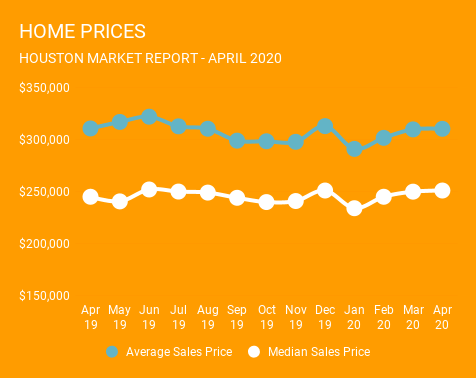

Despite the decline in home sales, home prices have been impacted very little. The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 2.4 percent to $251,000, the highest price ever for an April. The average price was statistically flat at $310,331.

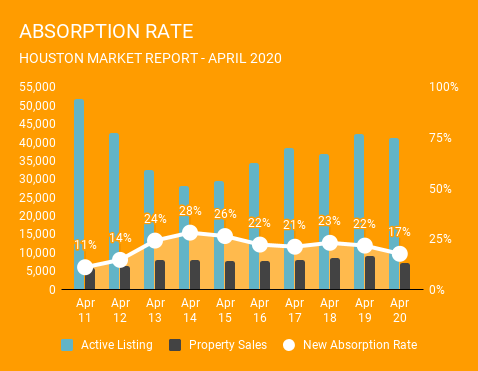

According to HAR, total active listings, or the total number of available properties, were statistically unchanged at 41,151 from April of last year. Sales of all property types totaled 7,192, down 21.6 percent from April 2019. As a result, the absorption rate for April 2020 was down to 17% from the 22% rate we saw in April of 2019 for all property types. We have to go all the way back to 2012 to find a lower absorption rate for April.

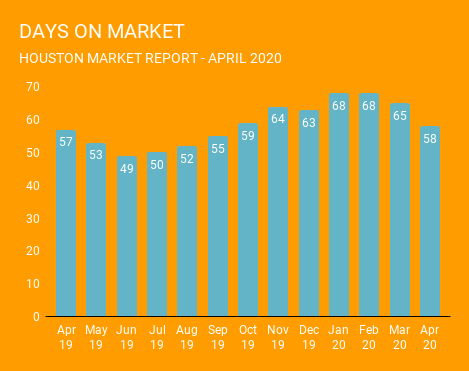

Days on Market (DOM), or the number of days it took the average home to sell, was down from March to 58. Single-family homes inventory was down as strong demand during the first quarter gobbled up housing supply that was never replaced with new listings. Inventory registered a 3.6-months supply in April, down from a 3.9-months supply a year earlier. For perspective, housing inventory across the U.S. stands at a 3.4-months supply, according to the most recent report from the National Association of Realtors® (NAR).

The market remains very fluid. We are monitoring from week to week and regularly updating the Covid-19 edition of our Houston market report. Whether now is the right time for you to buy or sell a home is going to vary depending on your location, your personal goals, and your current needs. Make sure to connect with a professional Realtor to discuss your particular situation, so you can make the right decision for you.