As you may recall, the real estate market in Houston was doing pretty well when we left off in July. Then this jerk named Harvey blew through Houston and mucked everything up. Maybe you heard about it?

As homeowners work through their insurance claims, the full impact of Harvey on the real estate market is still unclear. Near term there’s been some increased demand for short-term leases, and there has also been some dramatic reductions in inventory levels in neighborhoods that were impacted. However, the full effects may not be fully realized for weeks (and maybe months) as the market rebuilds and recovers.

Near term, the market experienced a huge decline in August sales. According to the latest report from the Houston Association of Realtors (HAR), single-family home sales plunged 25.4 percent, marking the first decline in almost a year. This level of decline may be a temporary blip. Harvey hit during the second to last week of the month. The last weeks of the month typically see the most closings. Many of the closings that were scheduled between August 28th through August 31st eventually closed in September.

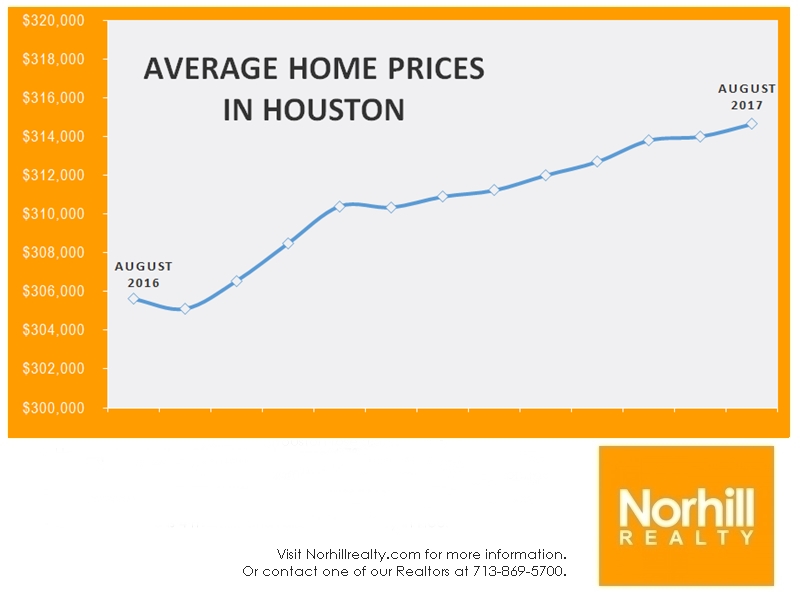

Across all market segments, average home prices in the Houston real estate market climbed 2.95 percent to $314,646 year over year ending in August 2017. The median home prices increased 5.39 percent between August 2016 and August 2017 to $215,000.

According to the Houston Association of Realtors, the 42,822 active listings in August 2017 represented a 12.4 percent increase over August 2016. Pending listings fell to 6,295, a 4.7 percent decrease from August 2016. As discussed earlier, actual home sales fell 25.4% to 7,077 over the same period.

Homes spent an average of 50 days on the market in August 2017, which is unchanged from the same period in 2016.

Inventory rose ever so slightly to a 4.4 month supply to 4 months, the highest in nearly five years. This number will more than likely fall as demand for homes unaffected by Harvey increases.

As we move forward and rebuild, the Houston real estate market will see a decline in overall production. However, with so many properties taken offline, we may see rising prices as demand increases in areas that were unaffected. Only time will tell what the full impact will be, as a result of the storm. Stay tuned….