The numbers are in. 2019 was was a healthy positive year for the Houston real estate market. Low mortgage interest rates, strong employment growth, and a stable home inventory all contributed to the record year.

According to the latest report from the Houston Association of Realtors (HAR), 7,505 single-family homes sold in December compared to 6,567 a year earlier for a 14.3-percent increase. The strongest sales activity took place among homes priced between $250,000 and $500,000, which rocketed 27.2 percent. Homes in the $150,000 to $250,000 range ranked second place, climbing 13.7 percent. The luxury segment, consisting of homes priced from $750,000 and above, increased 12.7 percent.

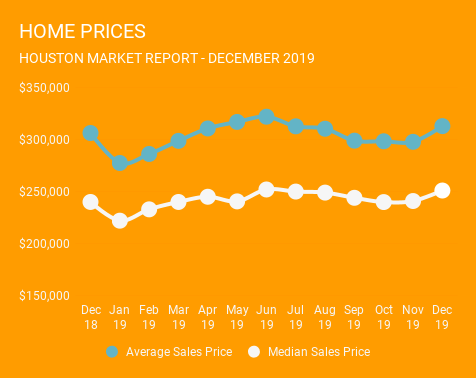

Prices of single-family homes set new December highs. The median price (the figure at which half of the homes sold for more and half sold for less) rose 4.6 percent to $251,000 while the average price went up 2.5 percent to $312,922. Despite those highs, pricing increases, in general, began to show moderation as the end of the year drew to a close.

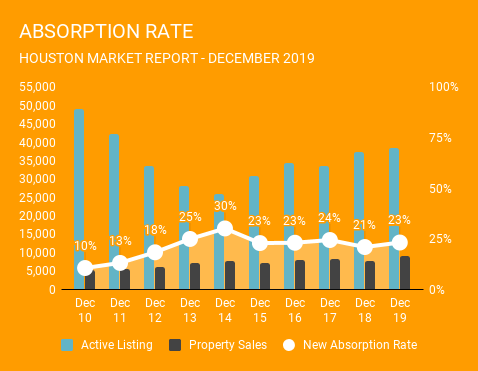

According to HAR, total active listings, or the total number of available properties, went up 3.6 percent to 38,504. December sales of all property types totaled 8,879, up 14.2% compared to the same month last year. As a result, the absorption rate for December 2019 was up slightly to 23% from the 21% rate we saw in December of 2018 for all property types.

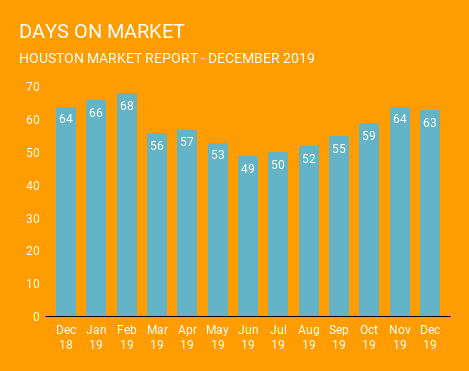

Days on Market (DOM), or the number of days it took the average home to sell, improved slightly from 64 to 63. Single-family homes inventory narrowed slightly from a 3.5-months supply to 3.4 months. For perspective, housing inventory across the U.S. currently stands at a 3.7-months supply, according to the latest report from the National Association of Realtors (NAR).

As we settle into 2020, these same dynamics should help push us into a similar direction over the next several months. Although home prices did begin to moderate towards the end of 2019, this should help home buyers in the market as they look to take advantage of the low interest-rate environment.