Well, we’ve come along way in 2020. Who would have predicted in March the economy and real estate market in Houston and across the country would have finished so strong. Of course, 2020 has been a very hard year for many of our fellow Houstonians and Americans, but hopefully, the resilience of the real estate market and the economy will help everyone bounce back much more quickly in the coming months.

According to the latest report from the Houston Association of Realtors (HAR), 9,652 single-family homes sold in December compared to 7,689 a year earlier for a 25.5-percent increase. That marked the seventh consecutive month that sales were on the rise.

The strongest sales activity took place among homes priced between $500,000 and $750,000, which rose 80.8 percent. The luxury market (homes priced at $750,000 and up) came next, climbing 54.0 percent.

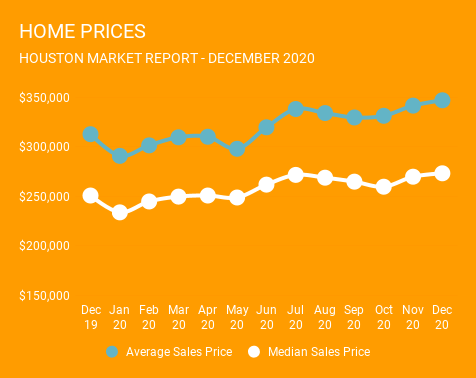

Prices of single-family homes established new December highs. The median price (the figure at which half of the homes sold for more and half sold for less) rose 8.7 percent to $273,443 while the average price went up 11.4 percent to $347,164.

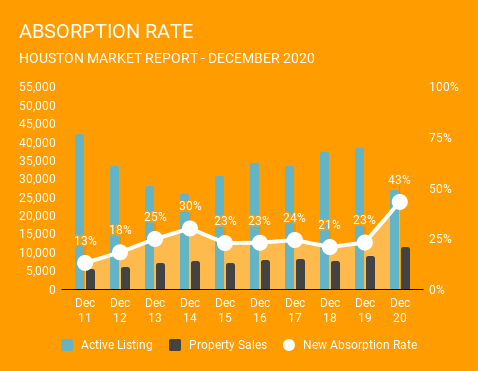

According to HAR, total active listings, or the total number of available properties, fell 27.2 percent to 26,821. December sales of all property types totaled 11,572, up 27.2% compared to the same month last year. As a result, the absorption rate for December 2020 was an astonishing 43%. That is some Bounty paper town level absorption.

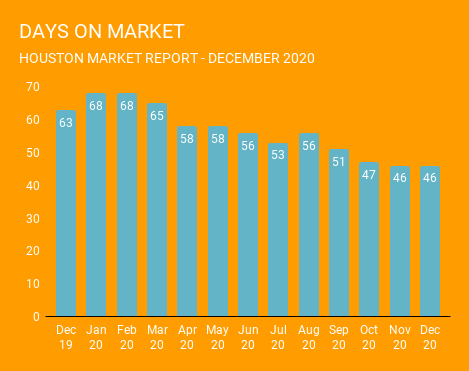

Days on Market (DOM), or the number of days it took the average home to sell has remained relatively steady over the past 3 months. In December, the average home sold in 46 days. Single-family homes inventory narrowed dramatically from a 3.2-months supply to 1.9 months. For perspective, housing inventory across the U.S. currently stands at a 2.3-months supply, according to the latest National Association of Realtors (NAR) report.

As we start this new (and hopefully less exciting) year, we expect the real estate market to continue to hold pretty steady. As the vaccine spreads across the city and state, we expect some prospective home buyers to reenter the market. With interest rates continuing to maintain near all-time lows, homebuyers should continue to be looking to take advantage. The big question mark for the 1st and 2nd quarter will be, “what will they buy?”. With inventory levels near all time lows as well, homebuyers will be faced with fewer options. This isn’t great for homebuyers, but it might be good news for home sellers that choose to list over the coming months.