Although some of the numbers are skewed due to last year’s deadly freeze that halted real estate activity for days, February was a very strong month for Houston real estate. Inventory levels remained extremely low and home prices continue to rise. If the first two months of 2022 are any indication, the spring real estate market should be very active.

Despite the rising mortgage rate and oil prices, homebuyers continued to gobble up available properties. According to the latest report from the Houston Association of Realtors (HAR), 7,372 single-family homes sold in February compared to 5,997 last February for a 22.9 percent increase. Homes priced between $250,000 and $500,000 led the way in sales for the month, registering an 80.1 percent year-over-year gain.

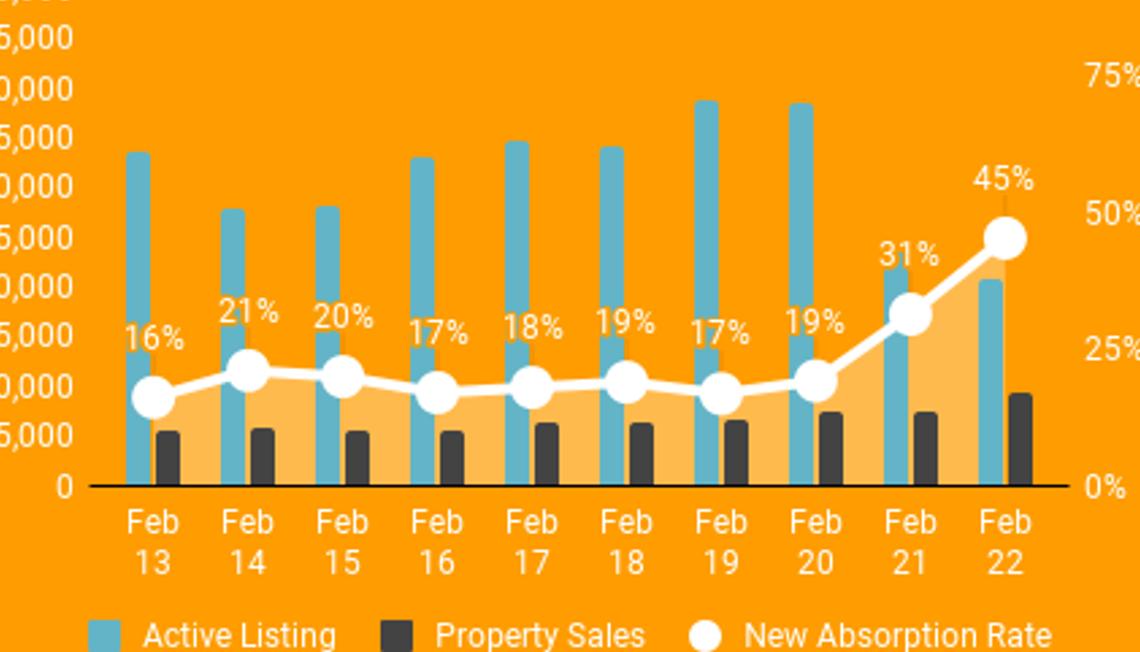

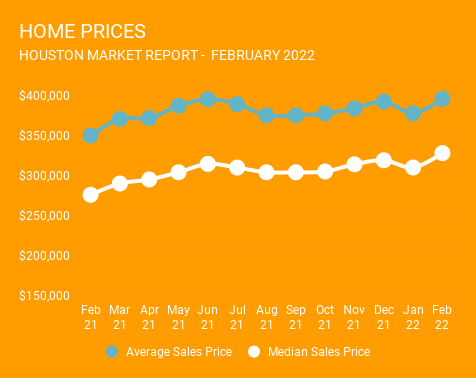

According to HAR, the low inventory levels for homes priced below $250,000 have forced many homebuyers into higher price points. This tight inventory environment has pushed prices to record highs. The average price of a single-family home rose 13.4 percent to $395,871 while the median price increased 19.3 percent to $328,000.

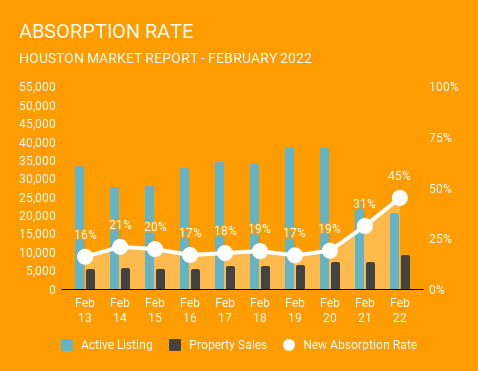

Homebuyers continue to gobble up homes near historic levels. Total active listings, or the total number of available properties, fell 10.7 percent as a result of the steady homebuying we’ve seen since the beginning of 2021. February sales of all property types totaled 9,299, up 25.6% compared to the same month last year. As a result, the absorption rate for February 2022 was 45 percent. That’s a 10 year high for February.

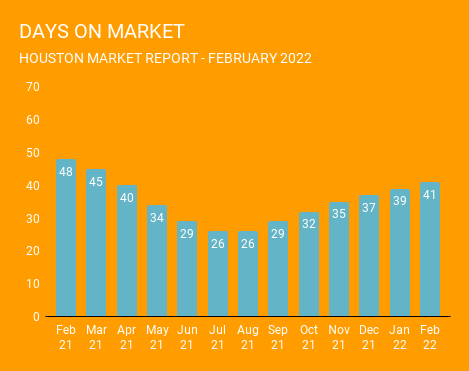

Days on Market (DOM), or the actual time it took to sell a home, has been gradually increasing over the past few months. In February, the average home sold in 41 days, which is still lower than 48 days on market we saw last February. Single-family homes inventory slid to a 1.3-months supply versus 1.5 months last February. That matches the historic low that inventory maintained from March through May of 2021. For comparison, housing inventory nationally is at a 1.6-months supply, according to the latest report from the National Association of REALTORS (NAR).

Although mortgage rates have returned to their pre-pandemic levels, the appetite for Houston real estate remains strong and does not seem to be abating. Rising oil prices could help spur additional investment in energy development worldwide, which could be a boon to the local Energy industry. In the short term, the spring selling season should be another strong one for home sellers. If home sellers are considering a move, this could be a good time to evaluate their options.