Although active, March 2024 saw the first sales slow down of the year. As the Sring homebuying season kicked off, home buyers saw an increasing number of options.

The dynamics of the market were a mix of both growth in inventory and a slight retreat in sales, providing a complex landscape for potential buyers and sellers in Houston.

Norhill’s Key Insights from the Houston Association of Realtors (HAR) March 2024 Market Update:

Single-Family Home Sales The Greater Houston area saw a 7.5% decline in single-family home sales compared to last March, recording 7,334 units sold against 7,926 in March 2023. This marked the first decline in sales for 2024, highlighting a cautious buyer sentiment amidst fluctuating interest rates.

Townhouse/Condominium Sales The townhome and condominium segments also faced challenges, with sales decreasing by 6.7% year-over-year, from 553 units in March 2023 to 516. Despite the sales drop, price levels continued to increase, indicating sustained interest in this property type.

Market Segments Across the board, all segments experienced slower sales, with the most notable declines at the lower end of the market. Homes priced below $100,000 saw a sharp decline of 28.9%, while the luxury segment ($1 million and above) experienced a marginal decrease of 0.4%. The luxury market has been very active since the beginning of the year compared to 2023.

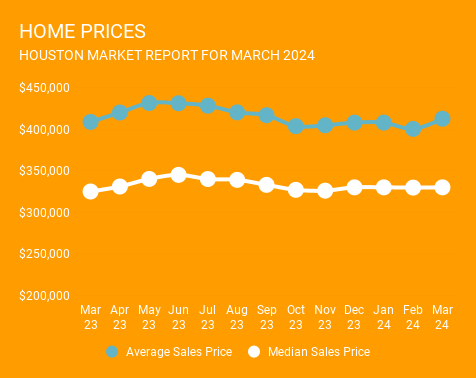

Home Pricing The average price for a single-family home in Houston increased modestly by 1.3% to $412,464, while the median price rose by 1.6% to $330,000, suggesting that, despite lower sales volumes, market values are holding steady.

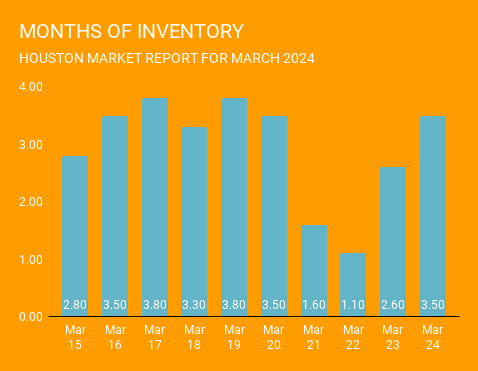

Inventory Levels Inventory for single-family homes rose significantly, from a 2.6-month supply last March to a 3.5-month supply this year, matching levels last seen in late 2023. The national inventory stands at 2.9 months according to the National Association of Realtors (NAR), with Houston showing a slightly higher local supply. The market has settled back into pre-pandemic inventory levels over the past few months.

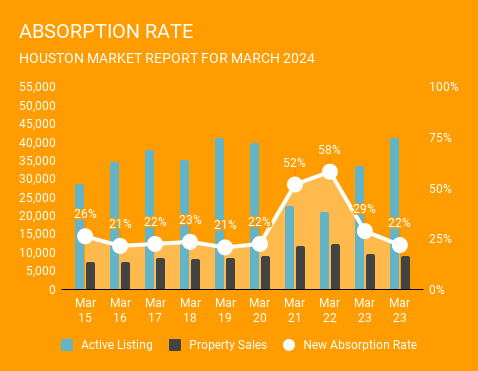

Likely to Sell According to HAR, total active listings, or the total number of available properties, increased 26.1 percent to 41,070. March sales of all property types totaled 8,939 down 7 percent compared to March 2023. As a result, the absorption rate, which is a measure of any given home’s likelihood to sell, for March 2024 was 22 percent. Like inventory, these numbers have settled back into more normal pre-pandemic levels.

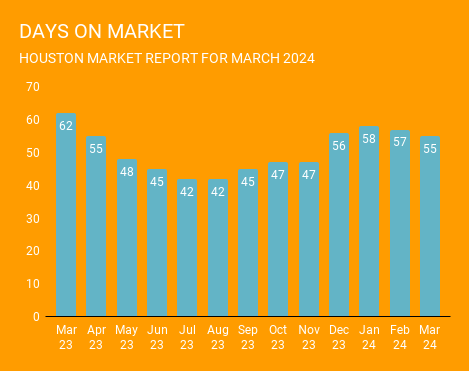

Days on Market The days on market for homes decreased from 62 to 55 days, suggesting that, despite the sales drop, homes that do go on the market are selling faster than in the previous year.

As we move further into the spring selling season, the Houston market presents varied opportunities for both buyers and sellers. Engaging with a knowledgeable local realtor, such as those at Norhill Realty, can provide critical guidance and insights, whether you are buying or selling in this intricate market. For a comprehensive overview and expert advice, consider connecting with Norhill Realty to navigate these trends effectively.

Fill out the form to get started.

GET MATCHED WITH AN AGENT