Since the beginning of the Coronavirus outbreak, many homebuyers have been waiting on the sidelines in anticipation of a coming buyer’s market. Based on economic history, this strategy seems justified. With unemployment way up and oil prices way down, Houston has looked like it might be on the verge of an inevitable and significant recession. But as the economy re-opens, the long term economic prospects look guardedly optimistic. Furthermore, the broad availability of mortgage forbearance and other government support programs make it unlikely that we are going to see a huge increase in foreclosures. In a typical recession, foreclosures drive increases in housing supply, which can cause a dramatic swing in the favor of homebuyers.

In a recent meeting with one of our mortgage partners, we discussed the ready availability of mortgage forbearance. Forbearance is when a mortgage company allows a borrower to pause or reduce payments for a limited period of time (side note: do your research before accepting forbearance as it may have a negative impact on your credit). Through the CARES Act, passed by Congress to help support the economy during the Coronvirus lockdowns, forbearance became fairly easy to gain approval for. As of last week, over 8% of all mortgages were in forbearance. If not for the availability of forbearance, many of these homeowners may have otherwise found themself in foreclosure proceedings.

During most recessions, foreclosures drive up inventory. Through the magic of supply and demand, rising inventory levels in available housing can lead to falling home prices. With rising inventory, homebuyers have more options, which provides them greater leverage in negotiations with home sellers. This shift in power helps an individual home buyer get a better price, and when multiplied across the market, pushes home prices down generally. With the availability of forbearance, this dynamic may never come to pass.

Furthermore, we have recently seen increased buying activity from homebuyers who were forced to wait during the lockdowns. Many of these homebuyers are either relocating to Houston or apartment dwellers who are ready to social distance in a larger space, preferably with a backyard. At the same time, we aren’t seeing an influx in new supply because many existing homeowners have decided to delay their upgrade to a new home due to the longterm economic uncertainty. This dynamic is beginning to bring inventory levels near or, in some markets, below pre-lockdown levels. In neighborhoods like the Heights, we are already starting to see instances of multiple offer situations and homes selling in a matter of days.

So will the Buyer’s Market ever come to Houston? It is hard to say. It seems unlikely we will see an increase in inventory levels due to rising foreclosures any time soon. That means inventory levels would need to come from people relocating away from Houston. However, if the economy continues to rebound (still a big if) and there is no second wave in the Coronavirus outbreak (another big if), then the buyer’s market may never come.

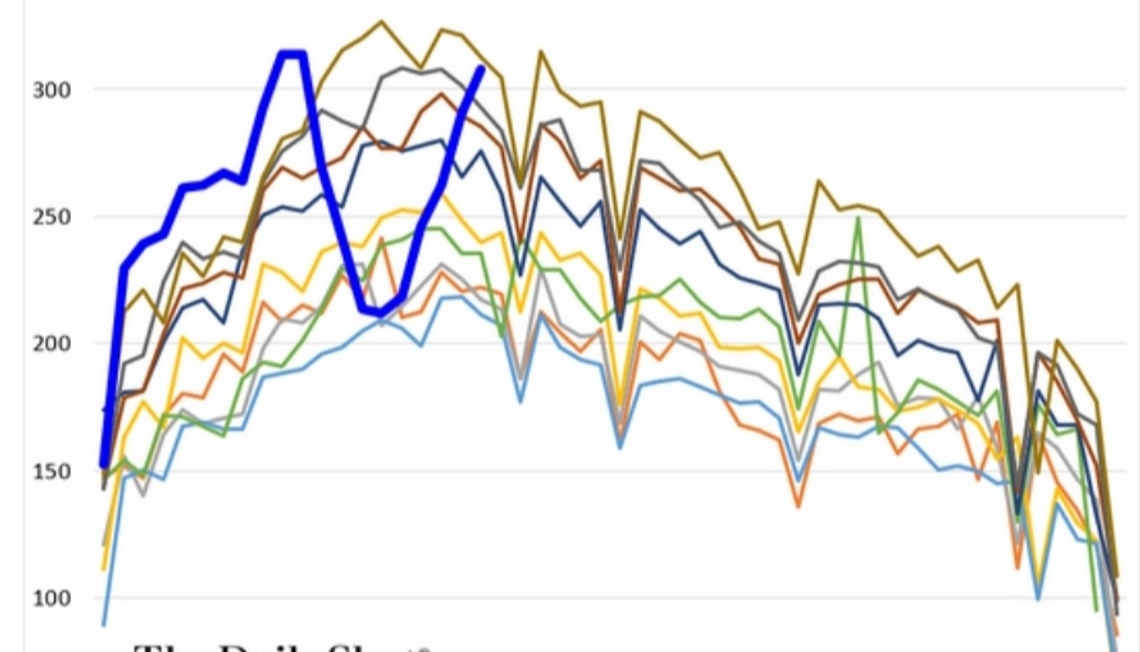

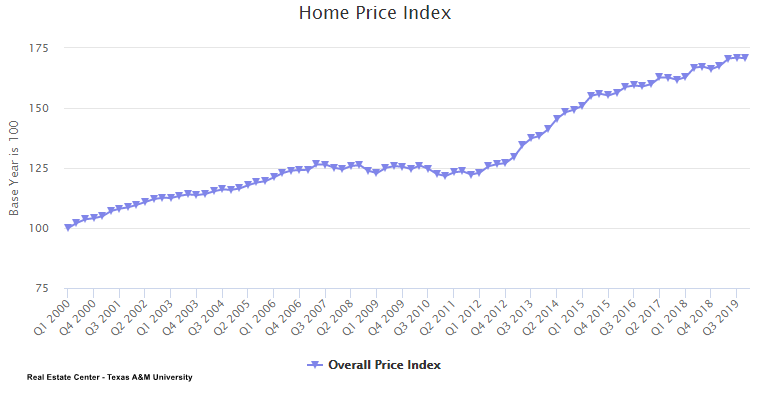

So if you’re a prospective home buyer what should you do? Well, first off, that’s a really personal question that depends on your long-term goals, the market you are interested in, and your personal financial situation. If you really want this question answered more precisely, you should contact a local Realtor in your market. However, we can give you one insight that might help put things in perspective. Mortgage rates are currently near all-time lows. If you bought a home at $400,000, the interest paid at 3.5% (just above the average current 30-year interest rate) over 7 years would be $72,842. At an interest rate of 4.25% (just below the average interest rate this time last year), you would pay interest of $89,186 over 7 years. In order to make up that difference, that $400,000 home would need to decline at least 2.5% in value over the coming months. According to the Real Estate Center at Texas A&M University, price declines of 2.5% or more didn’t even occur during the 2008 Great Recession, and the government wasn’t providing the kind of foreclosure prevention programs we are seeing today. So even if you did miss some price declines that may or may not be coming, then you might still be paying more over the long-term because you missed our current low interest rate environment.

Like you, we can’t predict the future, especially in these unprecedented times. There could be a second wave of Coronovirus the economic situation could be worse than stock market investors appear to believe. Regardless, for both home buyers and home sellers alike, we think it is important to be vigilant and get as much information as possible so you can make the right decision for you. Whether it’s with a Norhill Realty agent or an agent some other firm, get professional advice and develop a game plan for yourself and for your family.

If you would like to speak to a Norhill agent more about this topic, feel free to call us at 713-869-7500 or email us at [email protected]. You can also fill out the form below to get matched with an agent.

GET MATCHED WITH AN AGENT

Oops! We could not locate your form.